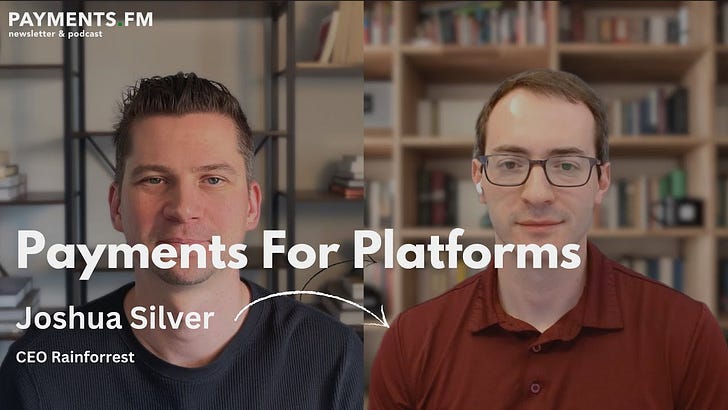

In this episode of Payments.FM, Joshua Silver, the CEO of Rainforest, delves deep into the intricacies of payment integration models for software platforms.

We discuss the two primary models: the integrated referral model and the embedded payments model. Joshua highlights the advantages and disadvantages of each approach and emphasizes the importance of service, technology, and commercials in selecting a payment provider.

We also touch on the challenges of fraud and compliance, and how Rainforest's unique approach mitigates these risks while offering a seamless user experience.

Tune in for actionable insights on improving your platform's payment performance and understanding the evolving landscape of the payments industry.

00:00 Introduction to Payment Models

01:58 Options for Integrating Payments into Software Platforms

03:15 Understanding Embedded Payments

05:15 The Role of Payment Facilitators

08:44 Balancing Risk for software platforms

16:06 Enhancing Platform and Merchant Experience

23:42 Competing in the Payment Platform Market

26:46 Challenges and Future of the Payments Industry

Full Transcript

Joshua Silver: I think broadly speaking, when you look at the market, there are really two ways to do it. There is what we call an integrated referral model where software platforms integrate into some technology stack, and then refer their merchants over to a payments processor who's going to handle all the sales, billing, and customer service.

There's really no industry that's immune these days from fraud. What we do to try to strike a good balance is to be smarter about it than the other payment providers.

Service is one of those areas that's not talked about very often, but in my almost 20 years of experience doing payments, it’s actually the most important thing. It should be talked about the most because, at the end of the day, it's really important to have a payments partner like Rainforest that is not only providing great service—I dare even say fanatical about service—but is being proactive about it.

Nikita Skitev: Today my guest is Joshua Silver, the CEO of Rainforest. Rainforest is a payment provider designed specifically for software platforms.

In this conversation, we talked about many interesting topics related to payments for platforms:

What are the different options that platforms can choose to enable payments?

Who manages the risk and owns the financial liability when it comes to payments?

How we can improve the buyer and seller experience on platforms from the payments perspective.

And of course, as usual, you’ll get actionable insights on how to improve your payments performance if you represent a platform or are just interested in payments.

With that, please welcome Joshua Silver.

Hi Joshua, thank you so much for joining Payments.FM.

Joshua Silver: Thanks for having me. Really great to be on the show.

Nikita Skitev: Let's start with a basic question. Let's say someone owns a software platform, like scheduling software for plumbers, and they think it would be great to add payments capabilities to their platform. So, service providers could not only use the platform for scheduling and billing but also to accept payments.

What are the options that exist today to enable payments?

Joshua Silver: Absolutely, happy to dive into that. I'm the founder of Rainforest, and we provide embedded payments processing services for software platforms specifically to enable that use case of paying the plumbers.

Broadly speaking, there are two ways to do it. First, the integrated referral model: the platform integrates into a technology stack and refers their merchants over to a payments processor who handles everything.

Second, the embedded payments model: the platform partners with a vendor like Rainforest to offer the payments product themselves. They handle all the sales, service, and billing—it’s fully embedded and fully native.

About 15 years ago, integrated referral models were the standard. But the downside is that the platform is sending its valuable customer to a third party. I encourage platforms—whether using Rainforest or another vendor—to move to an embedded model. That's what the most innovative companies are doing.

The key question: does the merchant know they're signing up with a payments company or think they're just signing up with your platform? You want it to feel fully integrated.

Nikita Skitev: If you're interested in payments content, please subscribe to Payments.FM on any platform you like. We’re publishing on YouTube, Spotify, Apple Podcasts, and more. Even better, you can go to Payments.FM and subscribe to our newsletter to ensure you don't miss any episodes.

Now, back to the topic. It’s maybe an outdated idea, but if a platform provides payments between buyers and sellers, do they need some kind of license because they're handling funds? Is that the case today?

Joshua Silver: Today, most of the payment volume going through software platforms is handled through what's called a payment facilitator, or PayFac. In the US, there are about 250–300 companies licensed by the card brands to provide payment services.

About 5-7 years ago, there was a belief that every vertical SaaS company would become a PayFac. But it’s incredibly difficult—you need licensing, sponsor banks, compliance programs, PCI Level 1 certification, and more.

Very few software companies pursue becoming a PayFac unless they process multiple billions of dollars annually. For everyone else, partnering with a PayFac-as-a-Service provider like Rainforest or Stripe Connect is the way to go.

Nikita Skitev: So, just to double-check: Rainforest is the PayFac, and that's what the software platforms use to offer payments?

Joshua Silver: Correct. Rainforest handles all the risk, compliance, money movement, and relationships with banks and card networks. Our platforms don't have to get licensed—they operate under our license.

And it's all fully white-labeled: the end merchant thinks they're signing up with the platform, not Rainforest.

Nikita Skitev: Let's dig deeper into the referral model versus embedded model. I'd imagine the referral model is less work for the platform—they refer customers and maybe have a revenue share agreement.

Embedded sounds like more effort but greater control and bigger benefits. Can we talk about obligations and benefits for platforms in the embedded model you provide?

Joshua Silver: Your intuition is right. Historically, embedded payments required a lot more technical work and program management: merchant onboarding, reporting, sales, and service.

At Rainforest, we’ve built embeddable components that make it almost as easy as a referral model, but you keep the benefits of embedded. Platforms can go live in under two weeks.

Additionally, we’ve simplified program management. We often hear from platforms that their support burden actually decreases after moving to embedded payments, because the payments product "just works."

Nikita Skitev: If we're talking about embedded payments, there are different flavors depending on who controls the risk, right? How do you handle that?

Joshua Silver: Great question. Who bears the risk if there's fraud? That's the key question every platform should ask—but many don't.

Sadly, most payments providers put the liability back on the platform—and often bury it in the contract. Platforms only realize the problem when they get a big bill.

At Rainforest, we do the opposite. If we’re handling onboarding and underwriting, we also take the risk. If there's a loss, we pay. Our incentives are aligned with our platform partners.

Nikita Skitev: So basically, you work on it together, but Rainforest owns the ultimate risk?

Joshua Silver: Exactly. It's definitely a joint effort, but Rainforest owns the risk responsibility.

Nikita Skitev: If you're controlling the risk, do some platforms complain that onboarding is too strict?

Joshua Silver: Absolutely. There's an old joke among risk professionals: "I can have zero losses if I don't approve anyone."

There’s a balance between high approval rates and low fraud. We’ve built vertical-specific and platform-specific risk rules to optimize both. We can approve more good merchants without exposing ourselves to more fraud.

We also use more data—platforms share richer data with Rainforest compared to others like Stripe, and we make smarter decisions as a result.

Nikita Skitev: I actually found you on LinkedIn because of a post you wrote—about Rainforest proactively identifying an integration issue for a platform. It feels like a great example of platform-focused service.

What, in your opinion, separates a good payment provider from a regular one?

Joshua Silver: Three pillars: product and technology, service, and commercials.

Everyone talks about pricing, but service is usually the biggest differentiator. We focus heavily on proactive service: monitoring integration errors, optimizing interchange costs, maximizing adoption rates, and offering strategic advice.

Payments is complex. It's not just "here's our API, good luck." You need a strategic partner.

Nikita Skitev: Let's switch gears and talk about the buyer and seller experience. If the platform provides payments, but options like Zelle, Venmo, Cash App, and Apple Pay exist—why would users choose the platform payments?

Joshua Silver: Great point. Some consumers prefer alternatives, but many transactions—especially in field services—still happen via checks and cash.

More payment options are better. Rainforest provides a standard platform that offers multiple rails—cards, ACH, instant payments—so platforms don't have to build multiple integrations.

Nikita Skitev: For sellers, what else can platforms do to motivate them to accept payments through the platform?

Joshua Silver: Focus on user experience: make it frictionless.

Also, offering features like instant payouts or integrated financing options can be really attractive. A plumber might close a bigger job faster if the customer can finance it on the spot.

Nikita Skitev: Now about Rainforest itself. Stripe and others already offer solutions for platforms. How do you see Rainforest competing in this space?

Joshua Silver: Great question. First, the US payments market is massive—90% of payment volume still goes through legacy banks and processors.

Stripe only has about 2-3% market share. There’s room for 50 companies like Stripe. We can win without it being a zero-sum game.

Rainforest wins by:

Having product and technology purpose-built for vertical SaaS.

Providing phenomenal service.

Offering platform-friendly commercial terms.

Platforms often have to compromise with other providers—with us, they don't.

Nikita Skitev: What's the most overlooked problem that merchants experience when starting to accept payments?

Joshua Silver: Risk and fraud. With AI-powered fraud rising, merchants need strong protection.

Also, user experience. Consumers today expect fast, seamless digital experiences—whether they’re buying an HVAC repair or a haircut.

Nikita Skitev: Broadly speaking, what's the biggest problem holding back payments from being safer, cheaper, and faster?

Joshua Silver: Again, risk and fraud.

Everyone talks about faster payments (FedNow, ACH innovations), but risk management is what drives the costs.

Think about wire transfers: they cost $30-$50, but the underlying transaction costs mere cents. It's the fraud prevention and risk mitigation that make it expensive.

The same dynamic applies across all payment rails.

Share this post